A tax audit may cover a period of one to three years of assessment determined in accordance with the audit focus. Return Form RF Filing Programme For The Year 2021 Amendment 42021 Return Form RF Filing.

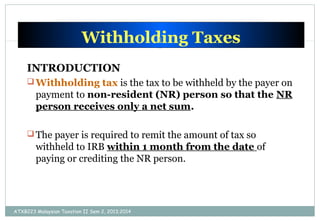

Introduction To Withholding Tax Imported Services Tax Part 2

10 or 20 0 or 20 20.

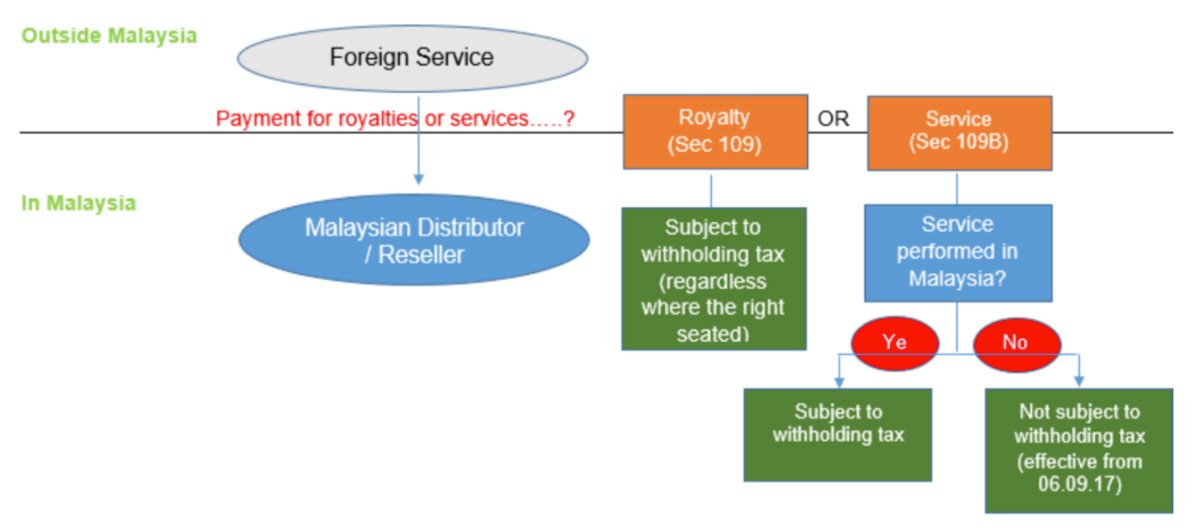

. 15 5 or 20 10 or 20. 1 Avoid dividend stocks listed in the US. As part of the deal JP Corp sent 3 engineers to Malaysia to assist in the installation of the machine and charged RM100000 for the installation services.

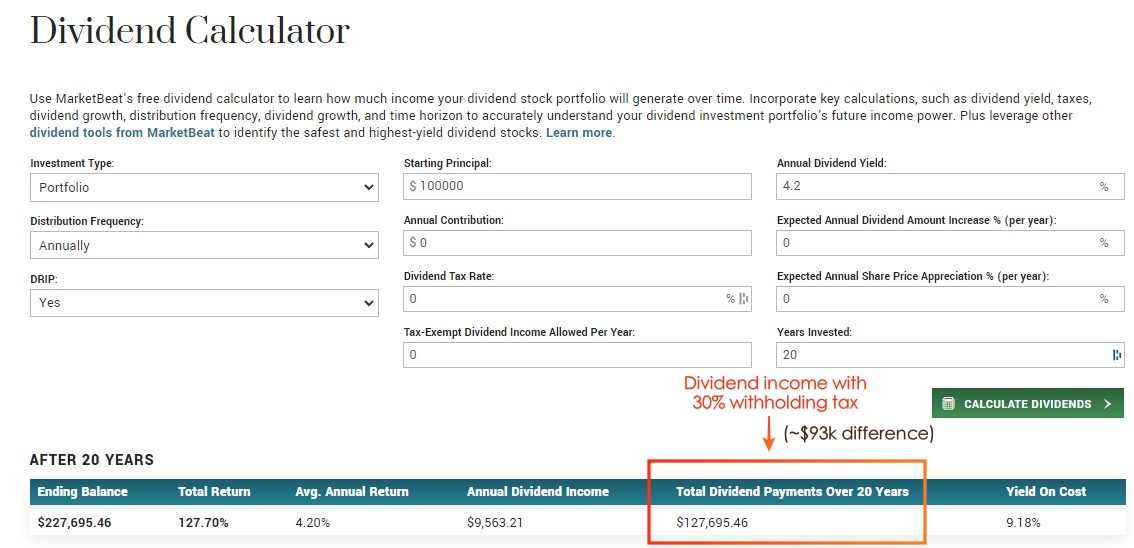

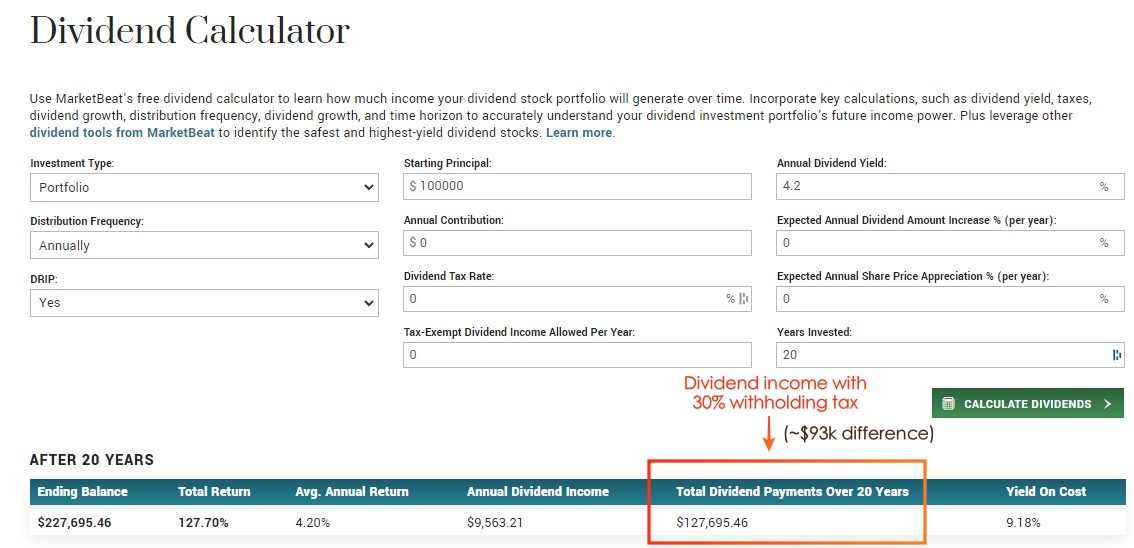

If a stock doesnt pay out dividends you are not subjected to the Dividend Withholding Tax. A tax withholding agent. Source How to Pay Less Dividend Withholding Tax.

There are four ways you can reduce the amount of withholding tax on your dividends. ABC Sdn Bhd is required to withhold RM10000 as tax to be paid to IRBM and JP Corp would be paid RM90000. Indian Income Tax Act 1961 makes it mandatory for all Indian companies and individuals to Withholding Tax Rates in India on all income earned by Foreign Companies NRI from the Indian sources.

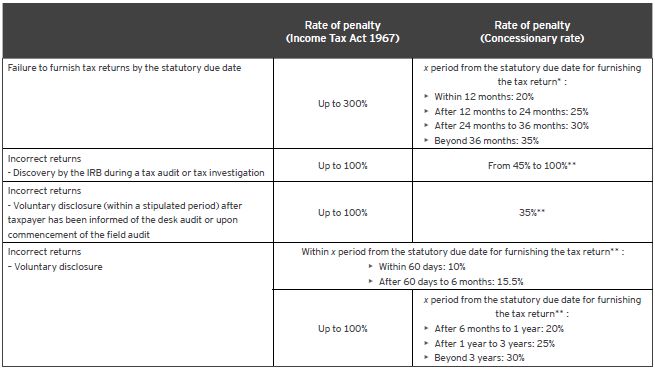

An individual earning less than P250000 a year is exempted from withholding tax where the income is coming only from a single payor ie. Offences Fines and Penalties. With this law the company has to inform the government on a quarterly basis about income and the amount of withheld tax.

Costa Rica Last reviewed 03. Criteria on Incomplete ITRF. These tax audit frameworks outline the rights and responsibilities of audit officers taxpayers and tax agents in respect of a tax audit.

Dialog Minutes For Operational. The installation fee of RM100000 is subject to 10 Malaysian withholding tax. Return Form RF Filing Programme.

Pensions annuities management fees interest dividends rents royalties estate or trust income and payments for film or video acting services when you pay or credit these amounts to individuals including trusts or corporations that are not resident in. If the gross income is higher than P720000 a 15 withholding tax based on the gross income should be applied. Hence if you wish to.

See the Withholding taxes section of Colombias corporate tax summary. Tax exemption for individuals earning less than P250000. Congo Democratic Republic of the Last reviewed 25 August 2022 Resident.

Part XIII tax is a withholding tax imposed on certain amounts you pay or credit to non-residents. 15 0 0. 10 or 20 0 20.

Congo Republic of Last reviewed 30 June 2022 Resident. If the company fails to inform the government about. The years of assessment to be covered in a tax audit may however be extended depending on the issues identified during.

Schedule On Submission Of Return Forms RF Contoh Format Baucar Dividen.

Types Of Withholding Tax Malaysia Sap Simple Docs

Reanda Malaysia Connecting Worldwide Audit Assurance Tax Advisory Services Reanda Malaysia

Blog Page 2 Of 3 Wecorporate Global Consultancy Sdn Bhd

Types Of Withholding Tax Malaysia Sap Simple Docs

Sponsored All You Need To Know About Dividend Withholding Tax For Malaysians Stocks Etfs No Money Lah

Notice Withholding Tax 10 Enagic Malaysia Sdn Bhd

What Is Withholding Tax How To Calculate Withholding Tax Best Sql Accounting Software

How The Finance Bill 2021 Affects Your Commission

Demystifying Malaysian Withholding Tax Re Run Kpmg Malaysia

Tax Amnesty Waiver And Remission Of Tax Penalty Withholding Tax Malaysia

Atomy Malaysia Withholding Tax Notice Facebook

Introduction To Withholding Tax Imported Services Tax Part 3

Types Of Withholding Tax Malaysia Sap Simple Docs

Types Of Withholding Tax Malaysia Sap Simple Docs

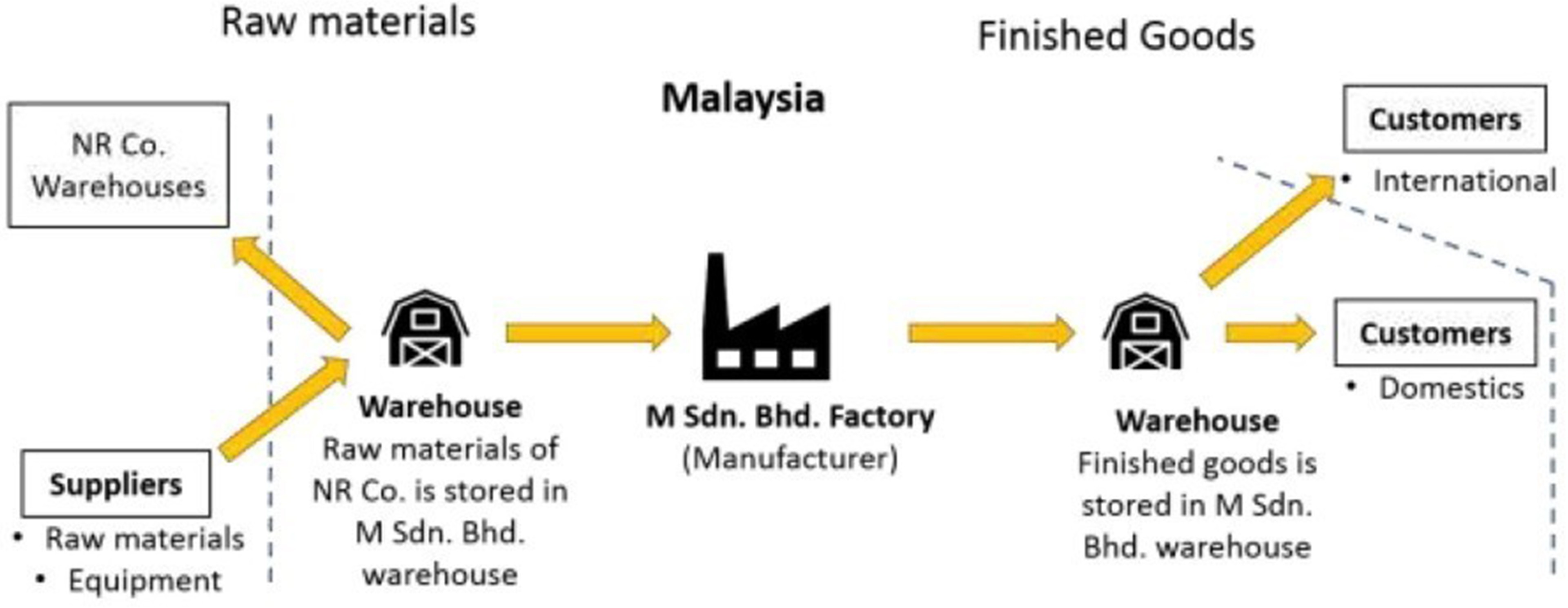

Guidelines On Determining If A Place Of Business Exists In Malaysia Ey Malaysia

Withholding Tax On Interest Income For Non Resident Company In Malaysia

Withholding Tax Service Tax On Imported Services For Digital Ads Services